Anne Main backs reasonable scrutiny of self-employed tax credit claimants

Anne Main outlines the need for a reasonable level of scrutiny of the self-employed when claiming tax credits in order to prevent abuse of the system.

Mrs Main: The right hon. Gentleman should take a little while to consider that not everybody who is self-employed is the entrepreneur he is talking about. The reason that degree of scrutiny is needed is that people who sell The Big Issue for a certain period of time can suddenly declare themselves to be self-employed, so the scrutiny is not something he should want to remove; it is a question of whether it is reasonable. If he wishes to help my right hon. Friend the Secretary of State, he might like to propose a constructive way forward for how we can stop people abusing the system by declaring themselves to be self-employed when all they are doing is a minimal amount.

Mr Byrne: Members on both sides of the House want this to work, but if the hon. Lady looks at the evidence submitted by the CBI and the Chartered Institute for Taxation to the Work and Pensions Committee on Friday, she will see that there is now a real worry that this is going to be a catastrophe for the many entrepreneurs who rely on tax credits for help to balance the books at the end of the month. What I want from the Secretary of State is clarity about how this is going to work in practice.

DISSOLUTION OF PARLIAMENT

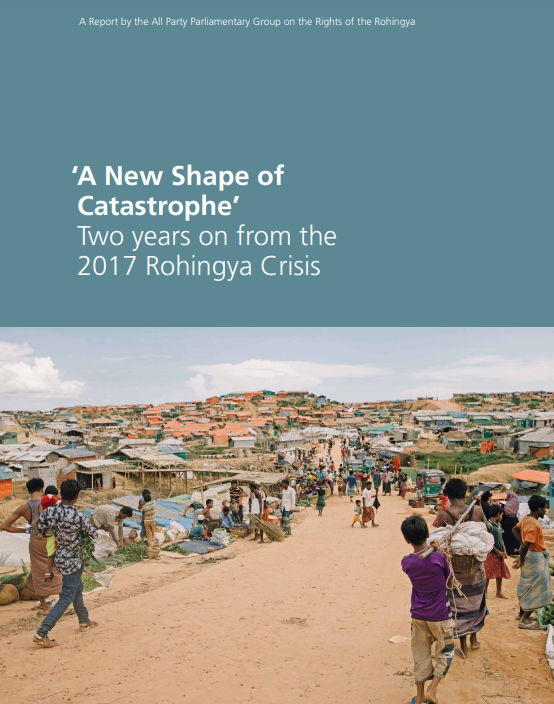

Watch: Anne Main, chair of the All Party Parliamentary Group on Bangladesh, talks about the Rohingya crisis and urges support for @DECappeal pic.twitter.com/FFL0lq8O0A

— DFID (@DFID_UK) October 12, 2017