2019 Loan Charge

During the Finance Bill debate yesterday evening, Anne Main raised the contentious issue of the Loan Charge during her speech. The Loan Charge relates to a policy change by government that is looking to recoup unpaid tax that the government claim was due on loans paid to self-employed workers and contractors over the last 20 years.

Opponents of this policy and those that are faced with hefty bills from HMRC say they were advised to use this method of payment by financial advisers and that it was lawful practice at the time. Campaigners on the issue also say that HMRC was made aware of this practice by individuals for years but never raised an objection.

The St Albans MP has been contacted by numerous constituents who have been impacted by the change in policy – some of whom are being pursued by HMRC for hundreds of thousands of pounds and face bankruptcy.

“I have serious concerns about the retrospective nature of the tax being collected”, said Mrs Main. “Several of my constituents were advised to use the scheme as a way of keeping more of their own money. It is worth remembering that these people are not employees. They take on more risk, with no sick pay, maternity pay or other forms of support offered to an employee.”

Mrs Main went on to blame HMRC for their handling of these cases, saying “I have constituents who say that HMRC was made aware of these arrangements but no objection was raised until many years later. That has to be fundamentally wrong.”

Anne ended her speech by saying directly to the Minister, “The huge pressure and distress – even suicidal thoughts – that this measure has put in people’s minds is totally unacceptable. I say to the Minister: if we do nothing else tonight, can we [hold a review of the Loan Charge policy].”

The amendment to the Finance Bill, which compelled the government to carry out a comprehensive review of the Loan Charge policy, was accepted by the government after considerable opposition and numerous Conservative MPs, including Anne, committed to voting for the amendment.

After the debate, Mrs Main was “pleased” the government accepted the amendment and called for “a full and comprehensive revaluation of how this policy has been handled”. Anne added, “There are serious and important questions to be answered on this. Of course people should pay their fair share of tax but, if this scheme was not unlawful and HMRC raised no objections when constituents shared the details of this with them, then we cannot allow retrospective taxation to take place. A full review will hopefully shine a light on this issue and the government will come forward with meaningful changes to how this is being handled.

“Hopefully that will include a far more reasonable repayment process, especially for those who are faced with an enormous amount to repay.”

DISSOLUTION OF PARLIAMENT

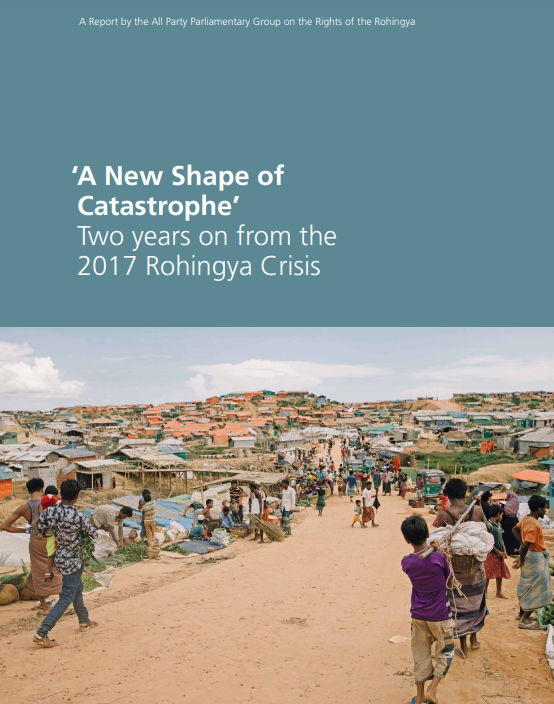

Watch: Anne Main, chair of the All Party Parliamentary Group on Bangladesh, talks about the Rohingya crisis and urges support for @DECappeal pic.twitter.com/FFL0lq8O0A

— DFID (@DFID_UK) October 12, 2017