Home-buyers ‘stamped on’ by ‘postcode tax’ says Anne Main

Today, in Parliament, Anne Main led a debate on the increasingly controversial Stamp Duty Land Tax (SDLT). This is the first time in recent history that SDLT, dubbed by Anne the 'postcode tax’, has been considered by Members of Parliament outside of its legislative context.

In the debate, the St Albans MP spoke of the ‘unfairness of bracket creep’, and how SDLT has ‘stamped on’ prospective buyers.

Anne said ‘Stamp Duty Land Tax is a strong contender for the UK’s worst-designed tax. Since the relevant rate applies to the full sale price.’

In Anne’s constituency of St Albans a person of average means, who moves home four times, may expect to incur a ‘total Stamp duty spend of £64,830 over a lifetime’. With the ‘current average wage in St Albans £37,440 per annum, that’s nearly two whole years’ pay just to move house.’

Anne went on to say that ‘St Albans residents pay 34% of their disposable income on their mortgage payment; this compares to 28% of the UK’s average.’

After the debate, Anne said she was ‘pleased we could finally debate stamp duty as a single issue. Local estate agents in St Albans have told me that the tax is distorting the market as buyers look to avoid paying the tax if the price is near a band threshold.

‘The average house price in St Albans is now over £450,000 and everyone in St Albans has been sucked in to paying this postcode tax. It’s outrageous that key workers, including public sector workers, are finding it increasingly difficult to live in my constituency and have to save for long periods to hand over a massive lump of cash to the Exchequer.

‘Doubtless SDLT revenues have rocketed in recent months and years, however, there is now a wealth of evidence to suggest that if the rates were to be reformed, Government revenues would not be hurt, meaning the Chancellor would still be able to continue filling the black hole in the nations finances.

‘I was very surprised to see that Labour* and Lib Dems did not bother turning up, given its growing importance across the country.

‘I am, however, pleased to be leading a campaign for a fairer tax system, and will continue to lobby hard on this issue. Home-buyers in St Albans and across the country are sick of being stamped on by the postcode tax.’

FULL TEXT:

Mrs Anne Main (St Albans) (Con): It is a pleasure to serve under your chairmanship, Mr Betts. This debate is broad, and I am sure that there will be various takes on stamp duty. I wanted it to be broad because people will have different views on what we should be doing about stamp duty, which is incurred by many constituents throughout the country.

Stamp duty land tax first appeared in its current form in 2003, and it is interesting to note that it has not been debated outside its legislative context since then. It was debated briefly in 2006, when the zero-rate threshold was raised from £120,000 to £125,000, but other than that the House has not debated it, yet stamp duty has been putting increasing pressure on home buyers since then.

I am sure that the public find it odd that such a burdensome tax affecting that most British of ideals—home ownership—has not been properly examined by Members in the House. As a Conservative, I am proud to say that I believe we are the party of home ownership. Indeed, it was under Margaret Thatcher in 1980 that we encouraged people to believe that owning their own homes gave them a stake in society and their community, aspiration and a belief that they and their families could get on. I am sure that many people in your constituency, Mr Betts, have aspired to own their own homes and taken up the right to buy introduced in 1980.

It is depressing to realise that, in constituencies such as mine, not a single property will be left below the 1% threshold. Even a tiny one-bedroom flat—an ordinary flat, not in a chichi area—will cost £170,000. I am concerned that by allowing so many people to be sucked into paying ever-higher rates of tax despite the fact that earnings have either risen only modestly or been frozen, such as in public sector jobs, we are denying our families of the future the chance to own their own homes. In 1980, we believed in encouraging families at all income levels to own their own home, and I hope that we have not moved away from that ideal.

Labour introduced the tax in 2003, but I believe that we should move away from politics on this matter, as the tax now sucks in many constituencies represented by Labour Members. Many of them are on the payroll, like Government Members, and will not be able to discuss the matter in this debate, but they know who they are. A quick look on Rightmove, Zoopla or similar sites will show how many constituencies—often ones with areas of multiple deprivation—have hugely expensive house prices. They are victims of what I like to call bracket creep.

The House might be interested to hear a few figures from Zoopla, showing how the tax hits huge numbers of people across the political divide. In Rutland, Leicestershire, the average house price is £319,000. In Witney, Oxfordshire, it is £324,000. In Twickenham, it is £653,000; in Bath, £355,000; in Cheltenham, £304,000; in Southwark, £653,000; in Bethnal Green, £447,000. I hope that I have demonstrated in that snapshot that the issue affects all parties and areas across the country. The Chancellor might be interested to know that the average house price in his constituency of Tatton is £640,000, with a stamp duty liability of £25,600.

As MP for St Albans, I am regularly told tales of woe by home buyers there. When I asked my local estate agents at Collinson Hall what effect they believed the stamp duty land tax was having on the housing market, some of the things that they said were shocking. To quote their e-mail to me:

“I do, however, believe that the real lack of supply of properties in St Albans between £650,000 and £1 million is due to the majority of local people who in earlier times would have been looking to sell in this price range and buy upwards in the market deciding to extend their own property instead of moving, due to the moving costs including SDLT of around 6%. This scarcity is in turn having a direct impact on prices increasing.”

People’s lack of willingness to move and their decision to stay put, rather than be clobbered with the duty, is resulting in a sclerosis in the market.

Shockingly, Collinson Hall went on to say that

“we find that more buyers use stamp duty as a negotiating tool to drive an asking price down, and we do have to be extremely careful when pricing a property that would be close to a stamp duty threshold. For example, if we feel a property is likely to be worth £265,000, the conversation would likely be, ‘You are definitely going to get £250,000 because of the change in stamp duty, but if you price it at £275,000-£280,000’”—

thus inflating the price—

“‘you may get someone that feels it is priced enough over the threshold to justify paying the extra stamp duty.’”

That is bizarre. I cannot believe that we should price houses to move them away from certain thresholds so that in the end people feel, “Well, they’re never going to accept the lower figure, so I’ll pay it.” It is having an effect on the market in areas such as mine.

According to the TaxPayers Alliance, by 2017-18, 87% of homes in St Albans will be in the 3% band or higher. If we believe that the levy was introduced to clobber those who are more affluent, I cannot accept that 87% of all homes in my constituency will catch those people. I have areas of multiple deprivation in my constituency, as I am sure do other colleagues here, and people there are being hit just as hard trying to stay in the area close to their families.

It is getting harder and harder for public sector workers to afford living in higher-priced areas such as my constituency. They are priced out by high house values and doubly clobbered by having to pay stamp duty. A tax that I believe was originally designed for wealthy home buyers now brings so much money into the Treasury that—I say this to the Minister—it is now seen as an untouchable cash cow, too big and too lucrative to be tinkered with.

Collection of stamp duty in its current form enshrines inequality, denies fair access to home ownership and taxes aspiration. It is discriminatory, targeting certain areas of the country regardless of ability to pay. That cannot be fair. Ordinary families are being clobbered the most by the tax. To give an example of how the middle-class postcode tax, as I call it, works, here are three starting salaries for public sector workers: a nurse is paid just over £21,000, a teacher just over £22,000 and a police officer just over £23,000. Those are certainly not riches beyond avarice, but many in the public sector in my constituency and others like it earn such salaries.

If such people are trying to save for their first home, they have a mountain to climb. While they wait to get their finances in place, they will face, according to Zoopla, a crippling average home rental in the south and east of £1,765 a month. They will have to shell out an awful lot of their modest salaries just to live in the area that they serve by working in the public sector. If they are not paying rent, they may be squatting like overgrown cuckoos in their parents’ home, while they pile as much money as possible into their savings pot or piggy bank to get on the housing ladder. If they are young graduates, 9% of their income will already have been sliced directly out of their salary through the tax system to pay for any student loans. They face a housing market that has risen by 27% over the past five years, according to the Office for National Statistics. House prices are zooming out of reach. They will have to scrape together a deposit and fees. Then, if they happen to be a victim of the postcode tax, they will have to save for stamp duty on top of everything else.

The reason why it is a postcode tax is that—as will become apparent if hon. Members go to property websites—in some postcodes, hardly anyone pays any tax to the Chancellor, not even 1% tax on a modest three-bedroom semi-detached house. In other areas, such as mine, the same house has a huge 3% tax bill attached to it. Houses of £500,000 and under are not mansions. They are ordinary family homes for many of us. That is why we must tackle the bands to banish the unfairness of bracket creep.

Take the middle figure among our public sector employees, a young teacher with a salary of just over £22,000. That salary would go a lot further, for example, in Droitwich, a pleasant spa town in the midlands where the average house price is £203,000—well under the 3% limit with a tax duty of just over £2,000. In St Albans, the same house would cost an average of £475,000. According to the latest figures, it would incur a whopping £13,701 in tax.

People working in our public sector, aspiring to achieve the same things, are, in certain areas, having to put a large amount aside to pay tax—and for what? What are they getting that that teacher in Droitwich does not get? They have the same salaries, same job, same hopes and dreams of their own home and, hopefully, a family; but in areas such as mine, there is a massive financial hill to climb, and people are finding themselves unable to access the housing market, no matter how hard they work or save, and doomed, at best, to squeeze into tiny spaces unsuitable for family living.

Is it any wonder that, according to MoneySuperMarket, people are aged 36 before they can expect to get on the property ladder in the south and east? That is nearly middle-aged. By 36 most of us feel that we should have achieved things with our lives. We are sitting on a time bomb. A whole generation will, according to the Office for National Statistics, have their first child when they are 30—before the age at which they can expect to be on the housing ladder—and probably be divorced by 40, possibly due to the pressures of trying to get on the housing ladder, having spent their entire adult lives, or at least the most productive part of their adult lives, unable to put a roof over their own heads and battling financial stresses. That is not the mark of a caring or fair society. I do not believe that that was intended when stamp duty land tax was originally thought of. It is a stealth tax, because people are unaware of exactly how much they are going to pay until they find the house that they want to buy. It is not a tax that allows anyone to figure the amount of savings into paying it. It is variable.

This is a timely debate, as the major parties are now furiously refining their policies, which will later appear in manifestos, and then we will have a chance to thrash things out. It was interesting to see that in a speech in “Total Politics”—it was pointed out to me—the right hon. Member for Kirkcaldy and Cowdenbeath (Mr Brown), prior to the Labour party’s manifesto being made, gave a commitment to get rid of stamp duty land tax for all houses under £250,000. Sadly, that did not make it into his manifesto, or into ours. I should like to know the Labour party’s view of whether there should be movement in the bands.

It is time to give some helpful suggestions to the Chancellor before his autumn statement and tease out from the Labour party what commitments it would like to make to the British public, because as I said earlier, this affects everyone; it does not matter whether people are in a Labour, Conservative or Liberal Democrat constituency.

We have a duty to help the next generation get on the ladder to owning their own home. The Government have recognised this. On 30 April, during Prime Minister’s questions, I asked him about considering stamp duty thresholds and helping young people get on the housing ladder. He said that he was

“very happy to look at the issues that she raises, but the weapon that we have used to try to help young people who do not have rich parents but who can afford mortgage payments is Help to Buy”.—[Official Report, 30 April 2014; Vol. 579, c. 828.]

I agree with the Prime Minister that home ownership should not be about the bank of mum and dad, but in constituencies such as mine, it is about the bank of mum and dad. In many ordinary families, parents do not raid the savings account or the trust fund, but will often downsize to release equity.

It is ironic that in constituencies such as mine parents who trade down to release equity to help their children will usually pay stamp duty on their smaller property as well, and then hand over money to help pay the stamp duty on the son or daughter’s purchase. Taxed on the way up and taxed on the way down.

Although the Help to Buy scheme is a valuable tool that works in some parts of the country, as has been shown by statistics, the areas where it does work are those with lower-priced houses. It is not well taken up in areas with high-value house prices, such as mine. In the two years between March 2012 and 2014, only seven people have used the Help to Buy New Buy scheme in St Albans. No one has just used the Help to Buy scheme. Why? If a buyer cannot scrape together a big enough deposit to qualify for the Help to Buy scheme, how on earth are they going to save to pay the tax associated with it as well? The Chancellor is helping giving with one hand and taking back with the other. That is so unfair. If a young person qualifies for the Help to Buy scheme, where are they getting the money from for the tax due on a high-value property? It cannot be rolled up into their mortgage, so it is the bank of mum and dad again? I think that it would have to be; either that or, hopefully, somebody will lend it to them from another source. Therefore, we are pushing people more into debt.

We must not try to tinker with the Help to Buy scheme, because it will not remain in place in perpetuity for first-time buyers, and it certainly does not help people who are downsizing. Unless we tackle stamp duty, it will be an ever-increasing obstacle to property ownership. The Homeowners Alliance points out that stamp duty has risen 7.1 times faster than inflation, 6.5 times faster than average earnings and 4.6 times faster than house prices. Stamp duty is proving a significant barrier to first-time buyers getting on to the property ladder and slowing existing homeowners’ progress up the ladder. The average stamp duty bill is now the equivalent of 11 weeks’ wages—for what?

Too many constituents of all ages, whether they are moving up or down the ladder, point out the unfairness of being taxed multiple times in high-value areas such as the south and the east. People are taxed if a couple splits up and one has to buy the other out if they want a property; taxed if a divorcing couple have to buy two less expensive properties in areas like mine—they will still pay stamp duty—further diminishing their ability to stay in the area, which is perhaps where their children go to school; taxed if a separated single father tries to buy to stay near his children; taxed if they are elderly and want to downsize to help supplement funds for personal care. Taxed on the way up and taxed on the way down.

Stamp duty land tax is a strong contender for the worst-designed tax, because the relevant rate applies to the full sale price. Transactions of very similar value are discouraged to completely different degrees and there are enormous incentives to keep prices just below the thresholds, as Collinson’s estate agents have pointed out. The Government should move away from this slab structure and tackle the unfairness of paying stamp duty on ordinary homes below £500,000. Overhauling stamp duty, as my hon. Friend the Member for Esher and Walton (Mr Raab) said today in The Daily Telegraph, would fuel growth and increase wider tax receipts, and, above all, it would be fair and increase property ownership for those we say we would like to help.

These artificial ceilings distort the market. Builders tell me that home owners put off doing improvements to homes—I had an e-mail to that effect—that are at threshold level. What would be the point of making those improvements if no money would ever be recouped? Sellers come up with creative wheezes to stay just below the threshold. Such a ceiling reduces labour mobility, because people are discouraged from moving to where suitable jobs are available. Data from the Land Registry show bunching below stamp duty thresholds.

Let me mention a St Albans house move example that could so easily be an example from Cheltenham or Tatton. On average, a person moves four times in their lifetime. In St Albans and many other areas, particularly in the south and east, this could be their property journey: first home, a small flat, average price just over £262,463 and purchase price incurring 3% tax of £7,873; second home, a small terrace, average price of £393,543 but more than £11,806 tax due; third home, a modest family detached, £759,191 and now paying more than £30,000 tax; and when the family flies the nest, hopefully when deposits have been saved up, Mr and Mrs Average in St Albans downsize to their fourth home, a modest semi-detached at £492,802, paying nearly £15,000 in tax. Of course, that family could have moved many more times. Nevertheless, during those four moves, they will have a stamp duty spend of more than £64,000. The average wage is only £37,000 in St Albans, and obviously a lot less for younger people, so that is nearly two years’ pay just to be able to move house, on top of all the fees.

According to a Lloyds survey of my constituency, people in St Albans pay 34% of their disposable income on their mortgage payment, compared with the 28% average. Although stamp duty hits London and the south-east particularly hard, analysis of the data shows that it is a huge burden on the entire country. The key findings of this research are that in 2012-13, more than £4 billion was paid by home buyers in stamp duty, of which £3.6 billion was paid at a rate of 3% or more, which shows that a significant number—indeed, the majority—of homes are coming into this 3% bracket. We should not be clobbering people just because we can. I think that tax should be fair and proportionate and should not suck ever more people of modest means into its remit.

If a tax has a negative impact on society, as Members of Parliament, we should tackle it. It too easy to say, “There is a black hole. Let’s fill it.” I read in the paper yesterday that Mr Speaker has decided to spend £100,000 more in his budget. We spend a lot of money in the House moving the furniture around and decorating things that seem perfectly fine to me. We waste money, left, right and centre, in Departments, on ministerial cars, and so on, and even, I would say, giving free school meals that we cannot afford or do need to give to children in areas such as mine, for example. We can look at other budgets. Why are we clobbering young people trying to own their own home? It is not fair; it is too simplistic and too easy; and the desperate aspiration to get on the housing ladder means that people will have to stump up somehow, if they wish to do it.

It is obvious that the first two brackets are catching significant numbers of ordinary people, many of whom can least afford it. I call on the Minister—I am pleased to see him here—to go back to the Chancellor, persuaded of the case that we should get rid of this unfair postcode tax on thousands of ordinary families with homes worth less than £500,000. They are being stamped on by the Treasury, and it is just not fair.

DISSOLUTION OF PARLIAMENT

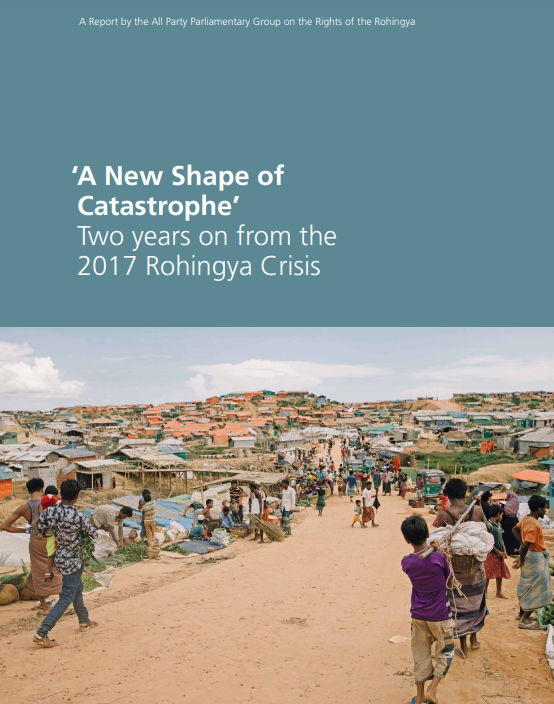

Watch: Anne Main, chair of the All Party Parliamentary Group on Bangladesh, talks about the Rohingya crisis and urges support for @DECappeal pic.twitter.com/FFL0lq8O0A

— DFID (@DFID_UK) October 12, 2017